A New Kind of Wealth: Gen Z Is Rewriting the Rules

For decades, financial success followed an acquainted pattern: earn steadily, save boldy, buy a home, and prepare for retired life. But Gen Z is approaching cash with a fresh perspective. Rather than concentrating only on long-term build-up, this generation is focusing on equilibrium, well-being, and intentional living.

This shift has actually generated the concept of soft saving. It's not about abandoning monetary objectives however redefining them. Gen Z intends to live well today while still bearing in mind tomorrow. In a world that really feels increasingly unpredictable, they are selecting satisfaction currently rather than postponing happiness for decades.

What Soft Saving Really Means

Soft saving is a mindset that values psychological health along with economic duty. It shows a growing belief that money should support a life that really feels purposeful in the here and now, not simply in the distant future. Instead of pouring every added buck into savings accounts or retirement funds, several young people are picking to invest in experience, self-care, and personal growth.

The surge of this approach was accelerated by the worldwide occasions of recent years. The pandemic, economic instability, and altering work characteristics triggered numerous to reconsider what genuinely matters. Faced with changability, Gen Z began to welcome the idea that life need to be appreciated in the process, not just after getting to a savings objective.

Emotional Awareness in Financial Decision-Making

Gen Z is coming close to money with psychological understanding. They desire their monetary selections to line up with their worths, mental health and wellness, and lifestyle ambitions. Rather than consuming over typical criteria of wide range, they are seeking function in just how they earn, spend, and conserve.

This could look like costs on psychological wellness resources, funding innovative side projects, or focusing on flexible living plans. These options are not spontaneous. Rather, they mirror a conscious effort to craft a life that supports happiness and security in such a way that really feels genuine.

Minimalism, Experiences, and the Joy of Enough

Many young people are turning away from consumerism in favor of minimalism. For them, success is not regarding having extra yet concerning having sufficient. This connections straight right into soft financial savings. Instead of measuring wealth by material possessions, they are focusing on what brings genuine joy.

Experiences such as travel, performances, and time with buddies are taking precedence over luxury items. The shift mirrors a much deeper wish to live fully rather than build up endlessly. They still conserve, however they do it with intent and balance. Saving becomes part of the strategy, not the entire emphasis.

Digital Tools and Financial Empowerment

Modern technology has actually played a major duty fit how Gen Z interacts with cash. From budgeting apps to investment systems, digital devices make it much easier than ever to remain notified and take control of personal funds.

Social network and online neighborhoods also affect how financial top priorities are established. Seeing others develop flexible, passion-driven occupations has motivated many to look for comparable way of lives. The accessibility of monetary information has encouraged this generation to create approaches that work for them instead of adhering to a conventional course.

This increased control and understanding are leading several to look for relied on specialists. Consequently, there has actually been an expanding interest in services like wealth advisors in Tampa who understand both the technological side of finance and the psychological motivations behind each choice.

Safety and security Through Flexibility

For past generations, monetary stability usually implied sticking to one task, buying a home, and complying with a fixed plan. Today, security is being redefined. Gen Z sees flexibility as a type of security. They value the capability to adjust, pivot, and explore several revenue streams.

This redefinition encompasses exactly how they look for financial support. Several are interested in techniques that take into consideration profession adjustments, gig job, innovative goals, and transforming family dynamics. Rather than cookie-cutter recommendations, they desire personalized support that fits a dynamic way of life.

Experts that offer insight into both planning and adaptability are becoming increasingly important. Solutions like financial planning in Tampa are advancing to include not only standard financial investment advice however additionally strategies for preserving monetary health throughout changes.

Realigning Priorities for a Balanced Life

The soft savings pattern highlights a crucial change. Gen Z isn't overlooking the future, but they're choosing to live in a way that doesn't sacrifice delight today. They are seeking a middle path where short-term enjoyment and long-term stability coexist.

They are still investing in retirement, paying off debt, and structure financial savings. Nonetheless, they are additionally including pastimes, travel, downtime, and rest. Their variation of success is more comprehensive. It's not just about total assets yet regarding living a life that feels rich in every feeling of words.

This perspective is encouraging a wave of adjustment in the economic services industry. Advisors that focus solely on numbers are being changed by those that understand that worths, identification, and emotion play a main function in financial choices. It's why much more people are turning to asset management in Tampa that takes an alternative, lifestyle-based technique to read more here riches.

The new standard for financial wellness blends strategy with compassion. It pays attention to what individuals really want out of life and builds a strategy that sustains that vision.

Comply with the blog for more understandings that show reality, modern cash behaviors, and just how to grow in ways that really feel both functional and personal. There's more to discover, and this is only the beginning.

Barret Oliver Then & Now!

Barret Oliver Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Karyn Parsons Then & Now!

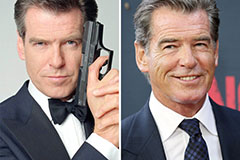

Karyn Parsons Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!